The President's Annual Economic Report to Congress Attacks Bitcoin

The Biden administration took aim at Bitcoin by using same old arguments such price fluctuations, lack of value, harm to nature, use in crimes, and so on.

The Economic Report of the President is an annual publication by the Council of Economic Advisers aimed at explaining the president's economic priorities and policies.

- The report's Chapter 8 gives exclusive attention to Bitcoin and digital assets - more than 30 pages, or one-tenth of the entire document. No other industry received such attention.

- The word "Bitcoin" has been mentioned 75 times - 48 times directly in the report, as well as 37 mentions in references. There is also an entire section which explains how Bitcoin works.

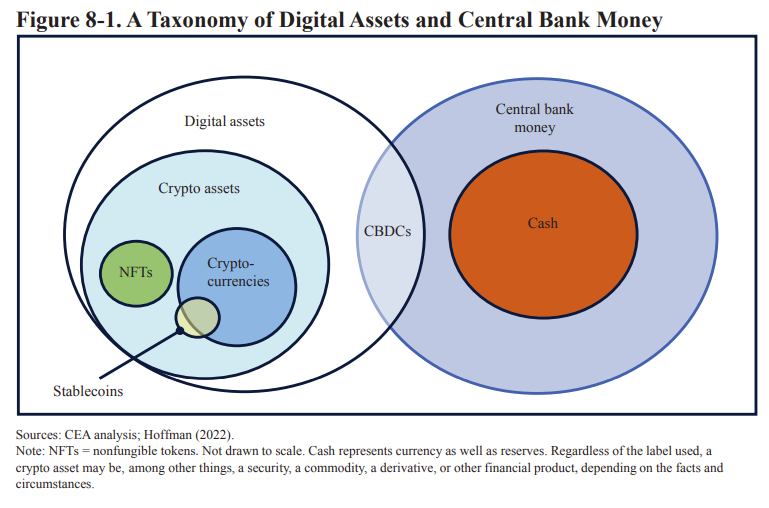

- The White House does not seem to differentiate between Bitcoin and other digital assets aside from the obvious fact that Bitcoin was the first cryptocurrency.

- Bitcoin is criticized due to its energy consumption and e-waste, citing widely disproved claims by Digiconomist and related sources.

- “Despite Ethereum’s switch to proof-of-stake, Bitcoin has not announced plans to make a similar change.”

- "Fortunately, there has not yet been a systemic crisis caused by crypto assets, in part because they are not yet fully integrated with the rest of the financial system, giving policymakers time to act appropriately. The risks presented by crypto assets stem from excessive speculation, high leverage, run risk, environmental harm from crypto asset mining, and fraudulent activities that harm retail investors and corporations."

- "...despite claims of being decentralized and trustless, blockchain-based applications are in practice neither; often, users access their crypto assets by going to a limited set of crypto asset platforms, and a small group of miners perform the majority of mining in most crypto assets..."

- The report acknowledges that "some crypto assets will not disappear and will continue to pose a threat to financial markets, investors, and consumers."

- It also acknowledges that current money works essentially because it is simply trusted, and government power stands behind it.

- The report tries to assert that the latest banking solutions (such as the FedNow instant payment service for US financial institutions) and CBDC (central bank digital currency) solve the same issues that cryptocurrencies are trying to solve.

- "A potential U.S. CBDC could also help support other policy goals. For example, a potential U.S. CBDC could help ensure that such payment systems are aligned with the principles of human rights, democratic values, and privacy."

- The report is released at a time when central banks contributing to the current banking crisis are trying to solve it using similar instruments that contributed to that crisis, and there are growing suspicions in the US that the government is really trying to take away the opportunity to use banks from the digital asset service providers.