Nearly 50% of Recent Hash Rate Increase Went To Foundry: The World's Largest Mining Pool Popular Among Corporations

Sam Wouters, Bitcoin Research Analyst at River Financial, has shared some insights about the recent Bitcoin hashrate surge.

Bitcoin's average daily hashrate recently touched 400 Exahash (a rather volatile metric, not to be confused with a more reliable 7-day or 14-day moving averages which currently sit at 330~350 EH/s).

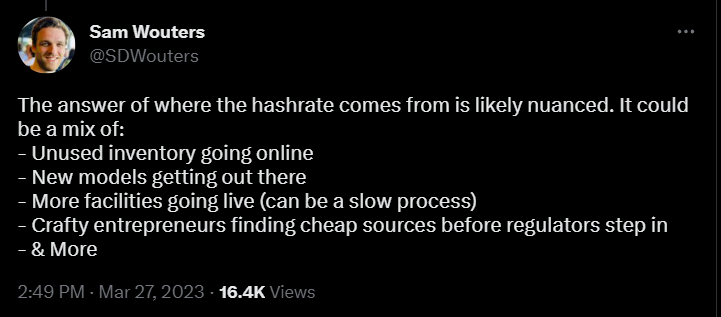

These developments prompted numerous speculations about where the new hashrate has been coming from.

- "Anyone can check to which pools the hashrate went. If you look at Waybackmachine for any pool data website, you get the following difference."

- So we know that:

~44 EH/s went to Foundry

~29 EH/s to AntPool

~8 to F2Pool

~7 EH/s to Binance Pool

~4 EH/s to Braiins Pool. - "We also know that Foundry has KYC, so the miners joining them are not "unknown" actors."

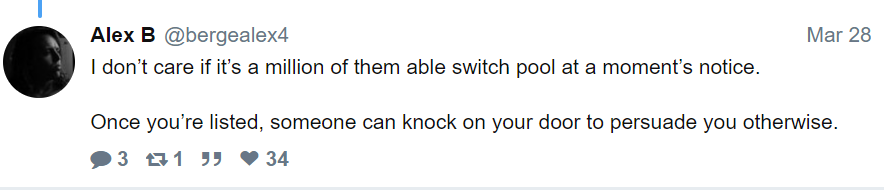

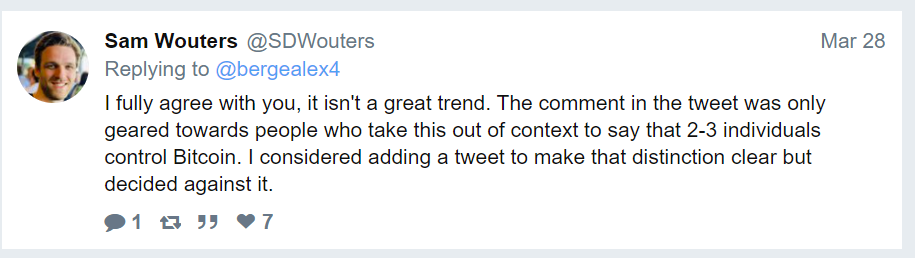

- Alex B and Sam also stressed that growing hashrate in mandatory KYC pool by Foundry isn't a comforting trend.

- Sam also expressed skepticism about the new hashrate coming from nation state miners. "I find it unlikely that the added hashrate would be mostly nation-states. Some people love to speculate about this, but the odds of such a thing happening and then remaining a secret are astronomically low. There are far too many people involved in running massive operations."

- "While Bitcoin's price was so low and as much inventory as possible was brought online last year, at some point maximum capacity of what the network could handle was reached. Now that the price has been rising again and some time has passed, more of this inventory has been able to go online."

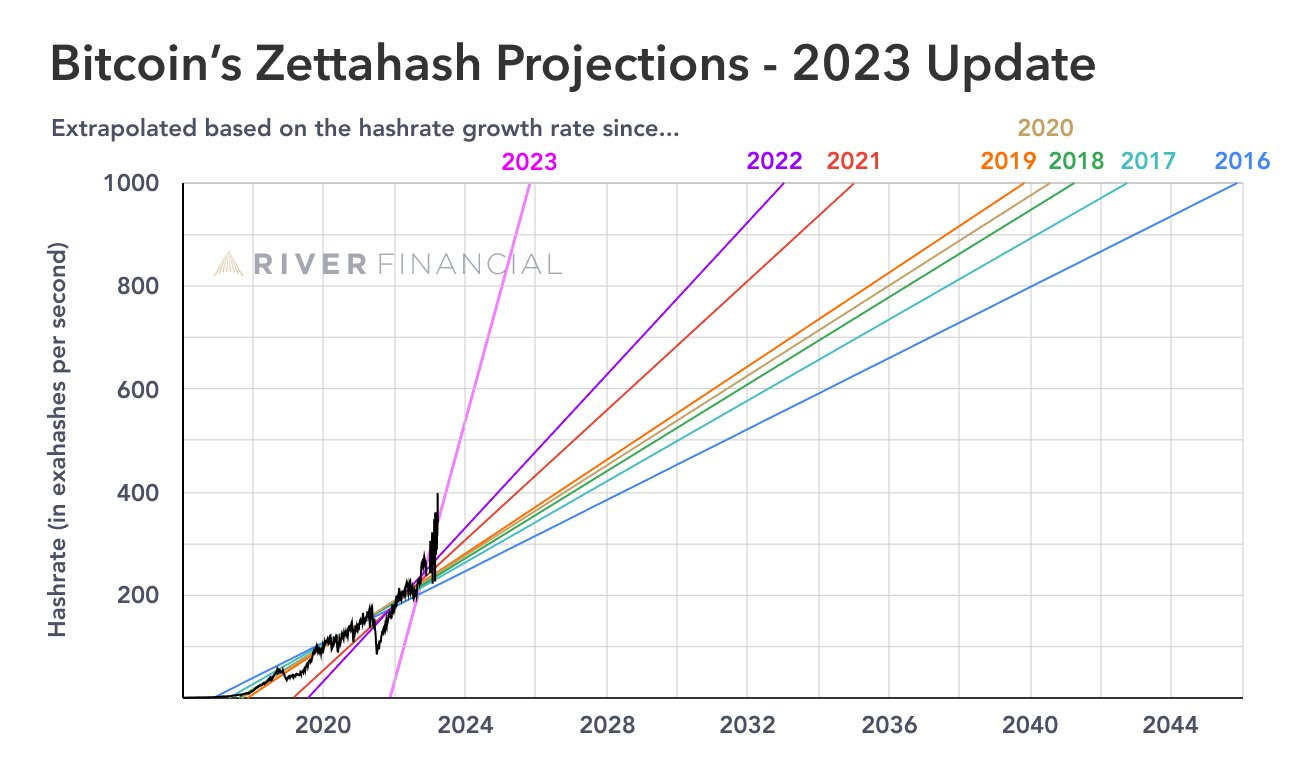

- According to Sam, "at the current growth rate in 2023, we'd reach a Zettahash by the end of 2025."