LN Markets Announces $3 Million Seed Round, Introduces DLC Markets

LN Markets announced a $3 million seed round led by ego death capital and introduced DLC Markets - a new way to trade derivatives for institutions.

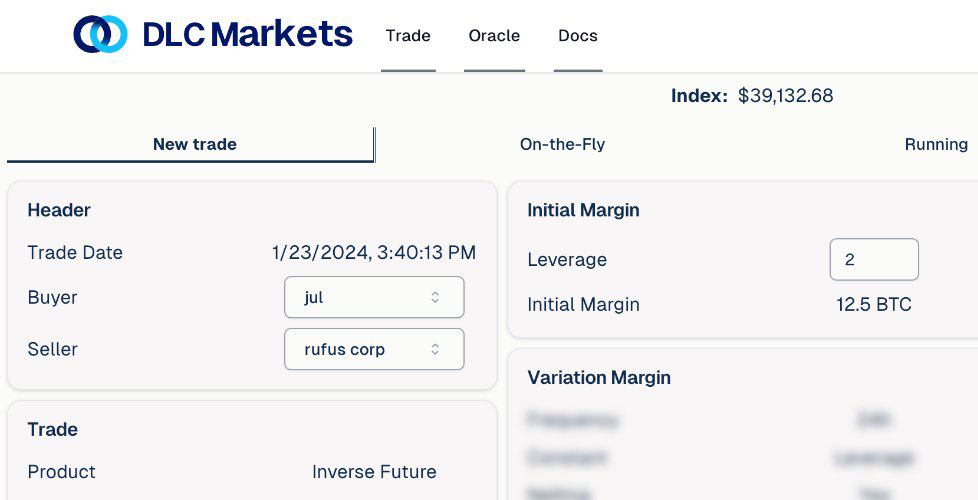

- "Over the past few months, we have been building in stealth mode a trustless OTC derivatives trading platform designed to meet the needs of crypto financial institutions: DLC Markets," announced LNMarkets.

- "DLC Markets represents a paradigm shift, offering a trustless and secure alternative to the centralized exchanges that have long dominated the financial sector. You can already sign up to try out our Beta!"

"Any kind of financial instrument can be traded on DLC Markets with almost no counterparty risk: Bitcoin futures and options, products on hashrate and blockspace, and potentially any asset in the world."

- "While traditional DLCs can be cumbersome to implement, we introduce a novel approach with a coordinator to solve the free-option dilemma when the DLC is initiated. This approach also makes it possible to integrate margin calls, liquidation and netting in the DLC process."

Visit DLC Markets website or read the project's whitepaper to learn more about the project.

- "To accelerate Bitcoin as an infrastructure, we have completed the raise of a $3 million seed round led by ego death capital, along with Lemniscap and Timechain, joining our current investors Arcario, Bitfinex and Fulgur Ventures," announced LN Markets in the same post.

"With their platform growing over 2600% over the last year and already facilitating over $2 billion in retail trading volume, LN Markets is set to redefine the derivative trading landscape," said ego death capital's Nico Lechuga.

- "We're thrilled to introduce DLC Markets, a pioneering platform developed by LN Markets. Utilizing Discreet Log Contracts (DLC), DLC Markets offers a trustless OTC derivatives trading environment. It's a game-changer, eliminating the need for centralized clearinghouses and revolutionizing how Bitcoin derivatives are traded," he added.

Bitcoin Magazine Article / Archive

Ego Death Blog Post / Archive

GitHub Repo

DLC Markets Whitepaper

Website