SEC Approves 11 Bitcoin Spot ETF Applications (Updated)

The U.S. Securities and Exchange Commission has approved 11 (out of 14) spot bitcoin exchange-traded funds, including those of Grayscale, Bitwise, iShares (BlackRock), ARK Invest, VanEck, Wisdom Tree, Fidelity and others.

- "Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares," said SEC's Chair Gary Gensler in a statement.

"The U.S. Court of Appeals for the District of Columbia held that the Commission failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed ETP (the Grayscale Order). The court therefore vacated the Grayscale Order and remanded the matter to the Commission. Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares."

- "Importantly, today’s Commission action is cabined to ETPs holding one non-security commodity, bitcoin. It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities."

- "While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto," he added.

- SEC's Commissioner Hester M. Peirce also released a statement, saying that these ETPs could have been approved years ago.

"We squandered a decade of opportunities to do our job. If we had applied the standard we use for other commodity-based ETPs, we could have approved these products years ago, but we refused to do so until a court called our bluff," she said.

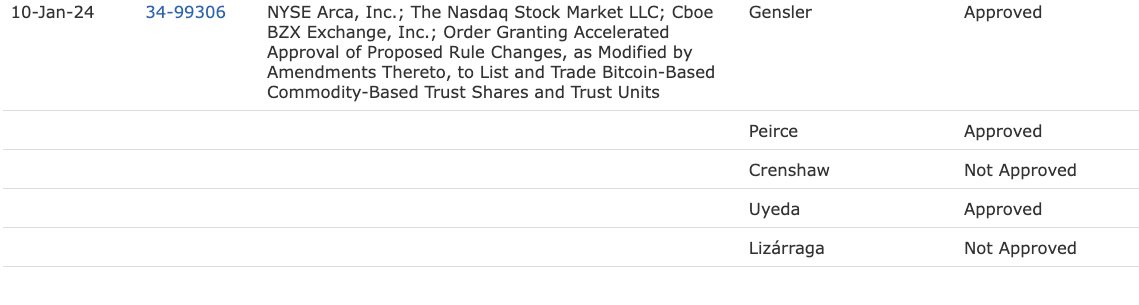

3 out of 5 Commissioner's voted for the ETFs to be approved, including the Chair Gary Gensler.

- Commissioner Caroline A. Crenshaw, who voted against the proposal, had this to say in her statement:

"Bitcoin is a peer-to-peer system. Individual investors in the U.S. who want to invest in the product may already do so, either by mining it themselves or by setting up a wallet and buying it from someone else, each of which they are able to do from the comfort of their living room. That is the whole point of creating a new, censorship-resistant digital currency. So why is so much energy being expended on linking it to the existing financial system?"

- "I fear that our actions today are not providing investors access to new investments, but instead providing the investments themselves access to new investors in order to prop up their price. While this is in the interests of the sponsors of the ETPs, as well as the law firms and service providers who will get paid by them, my duty is to consider investors, markets, and the public, whose overall interests I do not believe are in fact well-served today."

Gensler's Statement / Archive

Peirce's Statement / Archive

Crenshaw's Statement / Archive

Approval PDF / Archive