New US Tax Reporting Rule Requires an IRS Report for Every $10K+ Transaction

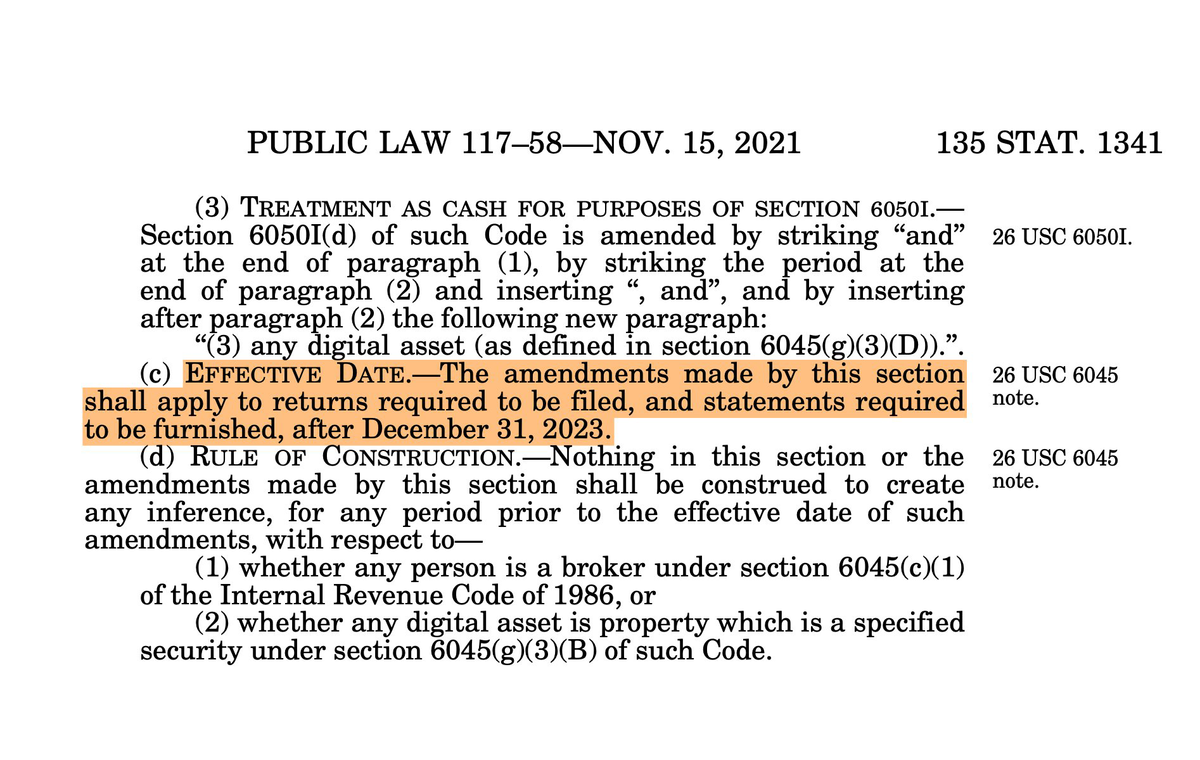

"The Infrastructure Investment and Jobs Act, which passed Congress in November of 2021, included a provision amending the Tax Code to require anyone who receives $10,000 or more in cryptocurrency in the course of their trade or business to make a report to the IRS," Coin Center wrote in a blog post.

- Since January 1, 2024, individuals who receive $10000 or more in bitcoin have an obligation to report the transaction (including names, addresses, SS numbers, etc.) to the IRS within 15 days under threat of a felony charge, said Coin Center's Jerry Brito.

"The report must include, among other things, the name, address, and Social Security number of the person from whom the funds were received, the amount received, and the date and nature of the transaction. If you don’t file a report within 15 days of receiving the transaction, you could be found guilty of a felony offense."

The obligation applies to *individuals* if they receive $10k+ in the course of their trade or business, not just "businesses." So, if I'm a miner (even as an individual) I'm covered. Also, if I'm a day trader (even as an individual) I'm covered. If I'm an NFT artist it would also… pic.twitter.com/kvPTv9GwPJ

— Jerry Brito (@jerrybrito) January 2, 2024

- "In June of 2022, Coin Center filed suit against the Treasury Department challenging the constitutionality of the new law, but that case is still in the courts."

"It’s no doubt only a matter of time before someone either buys a table sponsorship for our annual dinner or makes a contribution of $10,000 or more to Coin Center in cryptocurrency, and then we’ll be on the hook for complying and will have to figure out a way to do so."

- "The really tricky nature of this requirement will become clear when someone makes such a donation, but does so anonymously by simply sending us Bitcoin or Ether to our public addresses. Who could we possibly list as the sender in that case? These are all questions the Treasury Department has yet to answer," wrote Jerry Brito.