FCA's 'Consumer Protection' Regulations Make Centralized Exchanges Unusable for UK's Retail Bitcoin Savers

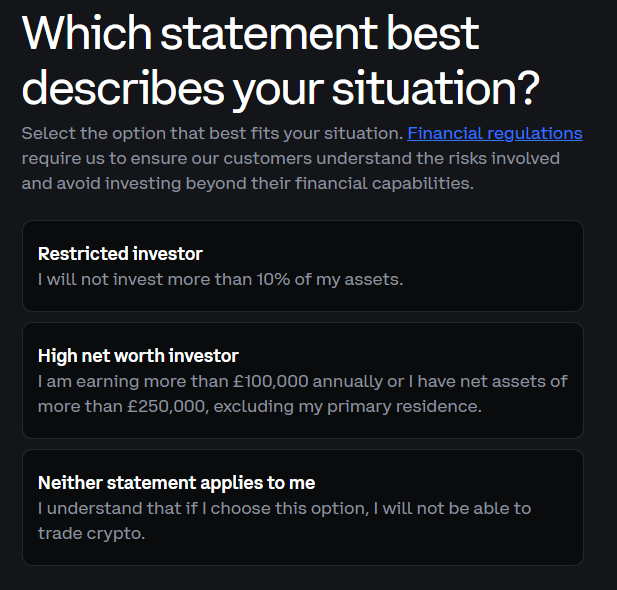

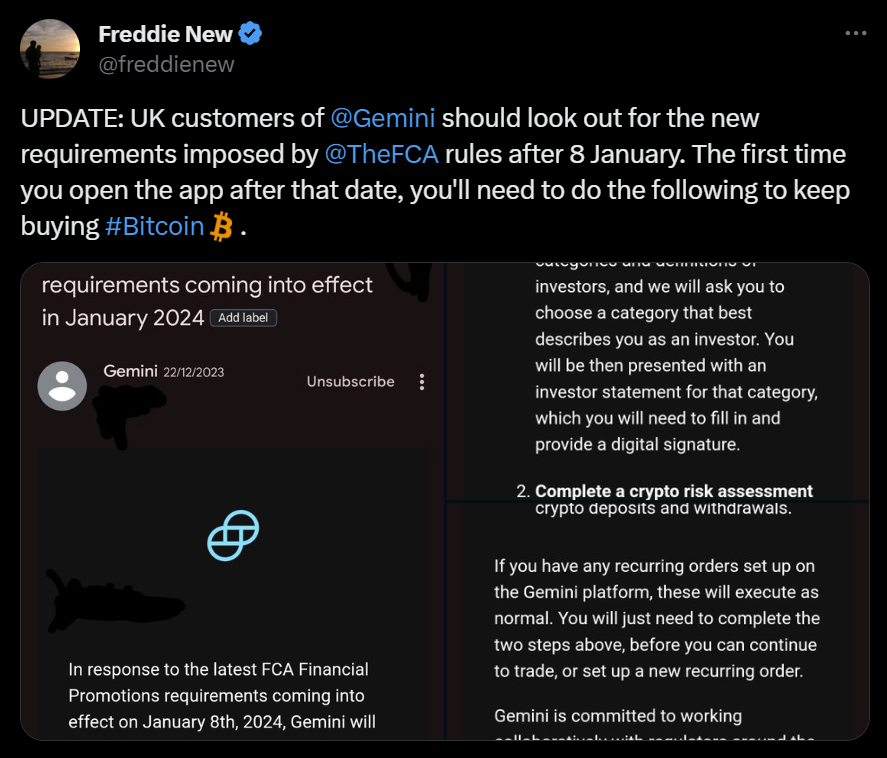

The new FCA rules for promoting bitcoin and 'crypto assets', categorizing them as 'restricted mass market investments,' came into effect on October 8, 2023. These regulations include a 24-hour cooling-off period for first-time buyers, client appropriateness testing, and categorization requirements.

- "You may be aware that owing to the erroneous categorization of Bitcoin by @TheFCA (which @bitcoinpolicyuk and the majority of the industry strongly argued against), exchanges in the UK are bringing in new ‘customer frictions’ before allowing you to buy or sell Bitcoin," reported Freddie New, Head of Policy at Bitcoin Policy UK.

- "The process normally involves two steps - firstly describing what kind of investor you are, and secondly passing a quiz or questionnaire. If you are a new customer, you will likely also need to wait for a 24 hour ‘cooling off’ period before you buy," he added.

"Remember, if you don't want to go through these absurd and unnecessary steps, you can always buy peer to peer without these restrictions from Peach Bitcoin, Hodl Hodl or Bisq, just for a start," said New.

- Other unrestricted P2P bitcoin buying options for UK investors include RoboSats, Agora Desk, Vexl, and lnp2pbot.

- In case of Bitfinex, the exchange recently announced removing "the availability of products and services in the United Kingdom for certain customers, in line with regulatory requirements."

- "@bitcoinpolicyuk have been collating examples of each and every exchange questionnaire that has been released so far. If you are struggling with the process, or if you want to get a sneak peek at what they look like, please check out the list below."

Coinbase

UPDATE - the @coinbase questionnaire is here. This is in two parts (investor designation and quiz). If you are a restricted investor, note that there are limits on your trading amounts. As a reminder, @TheFCA require this because of their erroneous classification of #Bitcoin as a… https://t.co/iG2858tA7a pic.twitter.com/wURcIE3iGZ

— Freddie New (@freddienew) January 5, 2024

Coin Corner

Update - if you are a @CoinCorner customer in the UK, you should soon be receiving a request to complete a questionnaire before you can buy any more #Bitcoin . This is a result of the erroneous classification of #Bitcoin by @TheFCA as a 'restricted mass market investment'. Watch… https://t.co/iG2858tA7a pic.twitter.com/iSrEQ5Luqx

— Freddie New (@freddienew) January 4, 2024

Revolut

Gemini

Crypto.com

UPDATE: for UK customers of @cryptocom, your investor selection and questionnaire has now dropped. This will pop up the first time you go to buy #Bitcoin . Walkthrough video is below! pic.twitter.com/y7LKqKIXvr

— Freddie New (@freddienew) January 8, 2024