Amboss Launched LINER Index For Measuring Cost and Yield on The Lightning Network

"Just as with LIBOR in traditional finance, it is incredibly useful to have a reference rate for the true cost of capital," said writer and investor Allen Farrington.

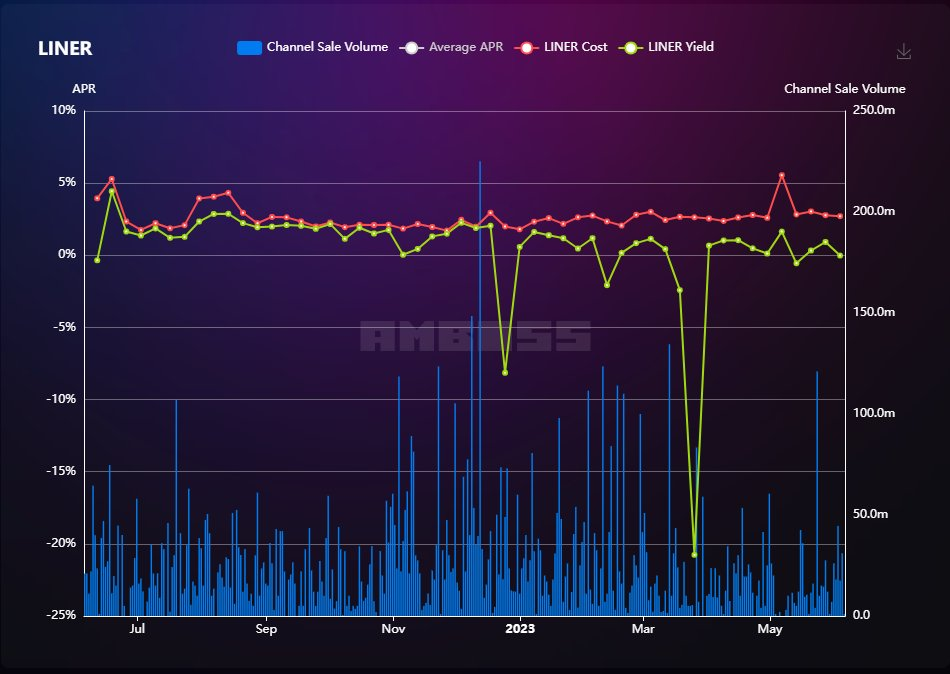

- Amboss, data analytics provider for the Bitcoin Lightning Network (LN), announced the launch of LINER (Lightning Network Rate), a first-of-its-kind index that demonstrates low risk yield for enterprise bitcoin holders.

- "LINER can be thought of as a benchmark interest rate for bitcoin free from credit risk."

- "LINER is similar to the LIBOR (London Interbank Offered Rate) in traditional finance, which is a benchmark interest rate for short-term loans between global banks, except LINER is free from credit risk."

- "In other words, LINER is well-positioned to be an alternative to enterprises seeking exposure to bitcoin without the credit risk that imploded CeFi yield platforms towards the end of 2022."

"By communicating real yield rates from bitcoin held on the LN, enterprises will recognize the strategic error in trusting CeFi yield platforms while capturing the benefits of payment network disruption that is decades overdue,' said Jesse Shrader, CEO and co-foudner of Amboss.

- "Unlike traditional reference rates that are set by a central bank like the Fed, LINER and other LN-native rates are derived entirely by free market forces — the first step towards money markets unmanipulated by a central authority, much less fragile and prone to the booms and busts of the traditional monetary order," commented Nik Bhatia of The Bitcoin Layer.

- Amboss operates Magma, a marketplace for buying and selling Lightning channels. Bitcoin yield with Magma comes from the liquidity needs of lightning-enabled payment destinations.

- "Since lightning channels are self-custodial ways to hold bitcoin, Magma enables novel bitcoin yield without custodial risk, avoiding the pitfalls of failed CeFi yield platforms," stated the press release.